ohio sales tax exemption form 2019

To claim the Ohio sales tax exemption for manufacturing qualifying manufacturers need to complete Ohio sales tax exemption Form STEC B which is a Sales and Use Tax Blanket Exemption Certificate and provide a copy of this certificate to their vendors. Precertification template 2016 2019 form.

Pin By Free Forex On Forex Trading Show Me The Money How To Get Rich Forex

This change results in the exemption of the sale of corrective eyeglasses and contact lenses pursuant to a prescription from sales and use tax on or after that date.

. In transactions where sales tax was due but not collected by the vendor or seller a use tax of equal amount is due from the customer. ID PTA Account ID or Exempt Status. If youve ever claimed a sales tax exemption on a purchase of farm goods you may have experienced some confusion over whether you or the good is eligible for the exemption.

How to use sales tax exemption certificates in Ohio. The instructions on the form indicate the limitations ohio and other states that accept this certificate place on its use. If purchasing merchandise for resale some wording regarding the resale of products will.

The purchaser must complete all fields on the exemption certificate and provide the fully completed certificate to the seller in order to claim exemption. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. Therefore you can complete the Ohio sales tax exemption certificate form by providing your Sales Tax Number.

How to create an eSignature for the sales tax exempt form ohio. 2019 Ohio IT 1040 SD 100 Instructions Email Click Contact at the top right on taxohiogov and select Email Us to access a secure email form. Nflpn gerontology certification 2018 2019 form.

The state sales and use tax rate is 575 percent. Step 3 Describe the reason for claiming the sales tax exemption. STATE AND LOCAL SALES AND USE TAX.

Enter a full or partial form number or description into the Title or Number box optionally select a tax year and type from the drop-downs and then click the Search button. Call You may call to speak with an examiner at 1-800-282-1780 during the Departments normal business. Sales tax exemption in the state applies to certain types of food some building materials and prescription drugs.

October 13 2021. Mail this form to the IRS and then wait to receive proof of tax exemption. Thats because Ohios sales tax law is a bit tedious and complicated.

Vendors name and certifi or both as shown hereon. Cms 838 2003 2019 form. Printable invoice for a homecare service provided 2018 2019 form.

Riverbend authorization form v2 draft 050616xlsx. Sales and Use Tax Blanket Exemption Certificate. Counties and regional transit.

The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from. Mail this form to the IRS and then wait to receive proof of tax exemption. Call You may call to speak with an examiner at 1-800-282-1780 during the Departments normal.

Fill out the Ohio sales tax exemption certificate form. 2019 Ohio IT 1040 SD 100 Instructions Email Click Contact at the top right ontaxohiogov and select Email Us to access a secure email form. In addition to requiring purchaser information such as name address and business type Ohio.

Many states have special lowered sales tax rates for certain types of staple goods - such as groceries clothing and medicines. Get more for ohio sales tax exemption form. Ohio unit tax exemption certificate.

Ohio sales tax exemption form 2020. In Ohio certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Online at taxohiogov Mobile App - Search Ohio Taxes on your devices app store.

Ad Download Or Email STEC B More Fillable Forms Register and Subscribe Now. Complete Form 532 and pay the 125 filing fee to become an Ohio corporation under your name sending the signNowwork to the Secretary of State. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

Obtain an Ohio Vendors License. Written by Peggy Kirk Hall Associate Professor Agricultural Resource Law. Youll need to describe your groups activities in the application.

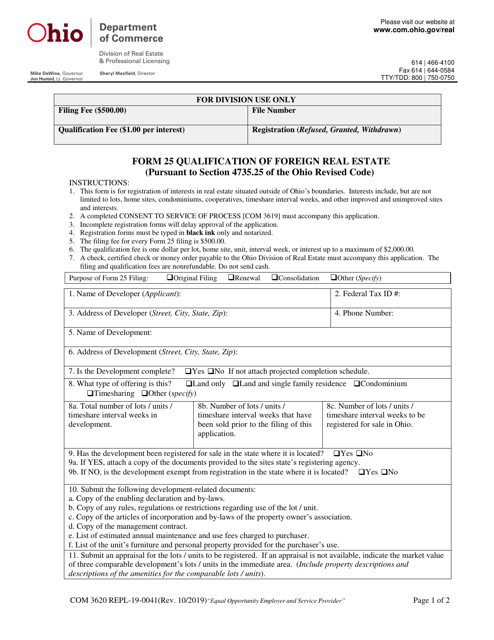

Ohio sales tax blanket exemption form 2019. Step 1 Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single transaction or STEC B for multiple transactions. STATE 6 AND LOCAL 1 HOTEL OCCUPANCY TAX.

Once you have that you are eligible to issue a resale certificate. Click here for specific instructions regarding opening and using any of our pdf fill-in forms if you are a Windows 10 user. PUBLIC TRANSPORTATION ASSISTANCE TAXES AND FEES PTA ADDITIONAL LOCAL CITY COUNTY HOTEL TAX This form cannot be used to.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax. Obtain a Sales Tax Account. Speed up your businesss document workflow by creating the professional online forms and legally-binding electronic signatures.

Complete Form 532 and pay the 125 filing fee to become an Ohio corporation under your name sending the paperwork to the Secretary of State. Purchaser must state a valid reason for claiming exception or exemption. Unicare fitness form reimbursement 2018 2019.

Step 2 Enter the vendors name. Ohio Revised Code RC section 573901FFF. Ad STF OH41575F More Fillable Forms Register and Subscribe Now.

Nflpn gerontology certification 2016 form. Sales Tax Exemptions in Ohio. Online at taxohiogov Mobile App - Search Ohio Taxes on your devices app store.

Sales and Use Tax Unit Exemption Certifi cate The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from. Ohio sales tax exemption form instructions. Vendors name and certi fi es that the claim is based upon the purchasers proposed use of the items or services the activity of the.

How To Get A Sales Tax Exemption Certificate In Iowa Startingyourbusiness Com

Is My 501c3 Automatically Tax Exempt Secure Nonprofit Tax E Filing 990 Ez 990 N Forms File 990 Blog

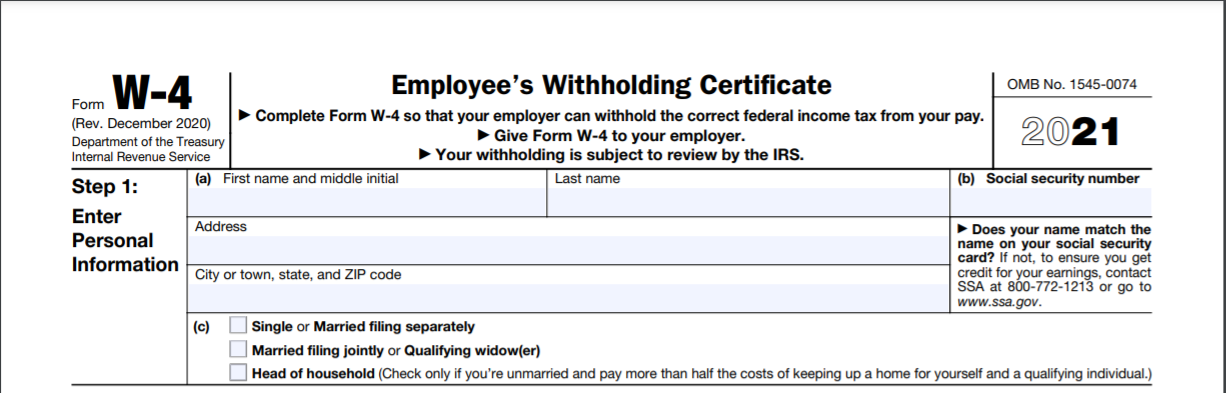

How To Fill Out Form W 4 In 2022

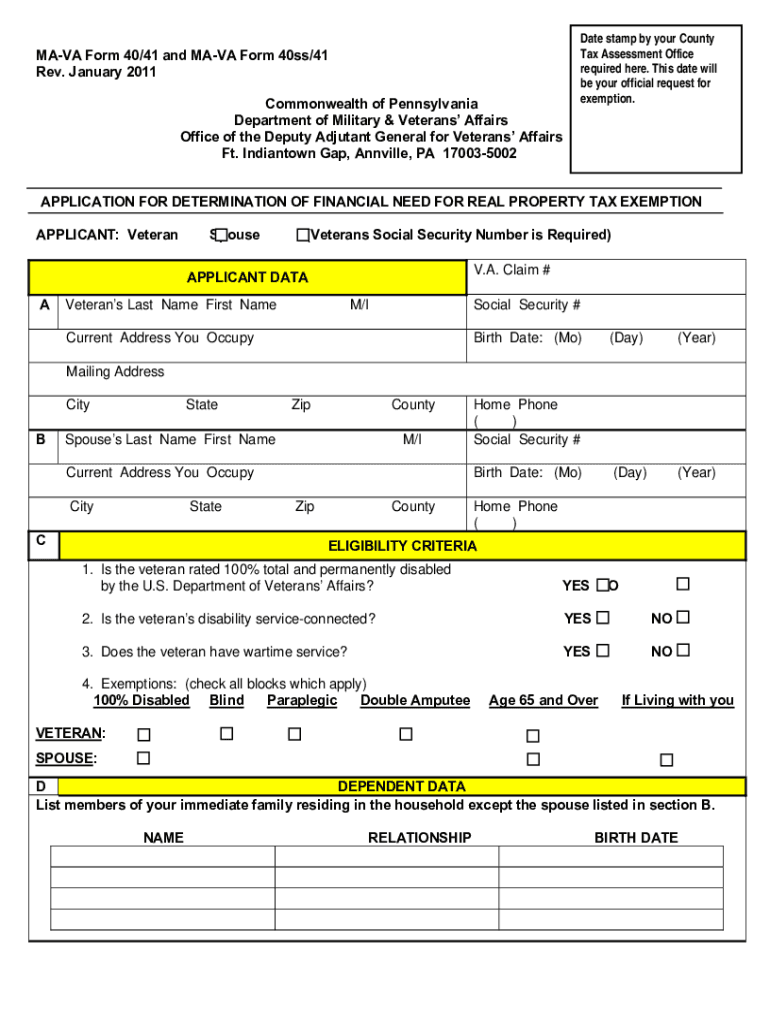

Ma Va Form 40 Fill Online Printable Fillable Blank Pdffiller

Arizona Transaction Privilege Tax Sales Tax Exemption For Manufacturing

Best Buy Military Discount Do They Have One Or Not

Pin By Vikram Verma On Nps Refinance Loans Nps Personal Loans

2022 Federal Payroll Tax Rates Abacus Payroll

Is My 501c3 Automatically Tax Exempt Secure Nonprofit Tax E Filing 990 Ez 990 N Forms File 990 Blog

How To Fill Out Form W 4 In 2022

Pin By Ratna Mishra On Business Loans Facilitation Schemes Unsecured Loans